Hey that’s just common sense and decency. I’m sure I’d do the same if I had the extra cash on hand. But that’s a huge difference from running a cashless game.I’ll double back, since as a boomer I am wise…

Just last night we did have player come to the session who hadn’t played in a couple months expecting a tourney (it was clear we’re only playing cash games when I talked to them) and only brought a certain amount of money. Instead of telling them where the nearest ATM was I said if they needed money they could Venmo me and I’d give them cash.

There is an application for this I guess.

They didn’t have to as they made their money at the table.

We’re still a bring your cash game but that is an option if someone got stuck and wanted to still play on.

Ken - An open-minded home game host

-

This site contains affiliate links. If you choose to make a purchase after clicking a link, Poker Chip Forum may receive a commission at no additional cost to you. Thank you for your support!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cash Game How I Bank at a Home Game in an Increasingly Cashless Society (1 Viewer)

- Thread starter ArielVer18

- Start date

This is the common sense answer for cash only games that several of us mentioned way back in this thread.Instead of telling them where the nearest ATM was I said if they needed money they could Venmo me and I’d give them cash.

All y'all just like to argue.

merkong

Full House

I know but I’m his thread is long.

Poker Zombie

Royal Flush

LOL at the nearest ATM on the mountain.I think it would have no impact here. Cash is expected and if anyone shows up cashless, I can direct them to the nearest ATM.

I'll bring plenty of cash to Denver, and my phone with whatever app is needed to Sweden. Everybody wins.

bergs

Royal Flush

Cash is king.

CONUS4EVAH

CONUS4EVAH

slisk250

Straight Flush

2 miles away at KS! Bring some ice on the way back!LOL at the nearest ATM on the mountain.

I'll bring plenty of cash to Denver, and my phone with whatever app is needed to Sweden. Everybody wins.

ArielVer18

Flush

People who are complaining this is too complicated are most likely veterans to hosting home poker and handling a cash only bank is like swimming or riding a bicycle to them. Many procedures may have been internalized and memorized to the point that doing them correctly is instinctual and requires no thinking at all. However, cash handling is a life skill that is rarely taught in school.

For example, take holding onto a wad of cash. How does one keep it organized? For US bills, most people will have a variation of this: two fat stacks folded in half held together with a rubber band or a hair tie with all bills face the same direction and the large denominations on the outside. One stack will have $100s, $10s, $5s, and $1s; the other stack will have $20s (most commonly used denom) on the outside and uncommon denoms on the inside (if you get troublemakers who bring $50s and $2s).

How about counting cash in front of someone? Do you lay out the bills face down so that the denomination is easily visible and arranged in a certain way? Will a third person, if asked, be able to quickly visually count your arrangement of bills?

I'll add a summary section to the OP when I draft up a more articulate paragraph. Essentially, cash-only method boils down to "cash for chips; chips for cash." Cashless is "record all chip buy-ins; leave with your profits or pay for your losses with a single transaction." My hybrid system is a combination of these two banking methods.

For example, take holding onto a wad of cash. How does one keep it organized? For US bills, most people will have a variation of this: two fat stacks folded in half held together with a rubber band or a hair tie with all bills face the same direction and the large denominations on the outside. One stack will have $100s, $10s, $5s, and $1s; the other stack will have $20s (most commonly used denom) on the outside and uncommon denoms on the inside (if you get troublemakers who bring $50s and $2s).

How about counting cash in front of someone? Do you lay out the bills face down so that the denomination is easily visible and arranged in a certain way? Will a third person, if asked, be able to quickly visually count your arrangement of bills?

I'll add a summary section to the OP when I draft up a more articulate paragraph. Essentially, cash-only method boils down to "cash for chips; chips for cash." Cashless is "record all chip buy-ins; leave with your profits or pay for your losses with a single transaction." My hybrid system is a combination of these two banking methods.

I'm early 50s / mid Gen X and play with people 35-75. Anyone older than me is all cash. Anyone my age or younger is fluent in all the payment methods, but we always still do cash. We are close enough of a group that we could just run a ledger and settle up at the end, but I would hardly recommend other games do that.

bergs

Royal Flush

Is everyone cool with a host (and possibly others) knowing exactly how much you’re up and down over a single session and a period of time with the ledger approach?

I couldn’t care less, but I’ve seen people in the past a bit miffed by it.

I couldn’t care less, but I’ve seen people in the past a bit miffed by it.

Poker Zombie

Royal Flush

I keep pretty detailed records/stats of our games. People seem to really like it. Before most games I select one player at random and provide a detailed analysis of their record, which I present directly to them (I believe they share it, but that's up to them). On two occasions, players have left and then called to make sure I didn't toss it out, because they wanted to bring it home.Is everyone cool with a host (and possibly others) knowing exactly how much you’re up and down over a single session and a period of time with the ledger approach?

I couldn’t care less, but I’ve seen people in the past a bit miffed by it.

It seems to me that most people think they are worse than they really are. Sort of like how everyone remembers the bad beat they received, but seldom remember the donk play that won them a pot. Remember the bad, forget the good.

Last edited:

We run a cash only game. While most of the group doesn’t seem to care (of course, if you pay attention for the evening you pretty much know what people bought in for and what they cash out for) we do have a couple peeps who like to try and hide that amount.Is everyone cool with a host (and possibly others) knowing exactly how much you’re up and down over a single session and a period of time with the ledger approach?

I couldn’t care less, but I’ve seen people in the past a bit miffed by it.

Jimulacrum

Full House

I keep my cash organized from smallest on the outside to largest on the inside. If there's any bill that I have a ridiculous pile of, I'll set aside a wad of it (e.g., $50 in ones or $500 in twenties), but otherwise it's all one roll. I'd prefer a small till if it's handy, but that's not always an option.People who are complaining this is too complicated are most likely veterans to hosting home poker and handling a cash only bank is like swimming or riding a bicycle to them. Many procedures may have been internalized and memorized to the point that doing them correctly is instinctual and requires no thinking at all. However, cash handling is a life skill that is rarely taught in school.

For example, take holding onto a wad of cash. How does one keep it organized? For US bills, most people will have a variation of this: two fat stacks folded in half held together with a rubber band or a hair tie with all bills face the same direction and the large denominations on the outside. One stack will have $100s, $10s, $5s, and $1s; the other stack will have $20s (most commonly used denom) on the outside and uncommon denoms on the inside (if you get troublemakers who bring $50s and $2s).

How about counting cash in front of someone? Do you lay out the bills face down so that the denomination is easily visible and arranged in a certain way? Will a third person, if asked, be able to quickly visually count your arrangement of bills?

I'll add a summary section to the OP when I draft up a more articulate paragraph. Essentially, cash-only method boils down to "cash for chips; chips for cash." Cashless is "record all chip buy-ins; leave with your profits or pay for your losses with a single transaction." My hybrid system is a combination of these two banking methods.

All bills facing the same way. Outermost bill of decent quality so I don't have an old crumply bill getting smooshed around in my pocket.

When I count out, I count the bills down onto the table like a bank teller, in piles of $100 or whatever makes sense.

Jimulacrum

Full House

I've never hosted a cashless game live. I've been hosting on a Mavens site since the pandemic, though, and that's of course cashless.

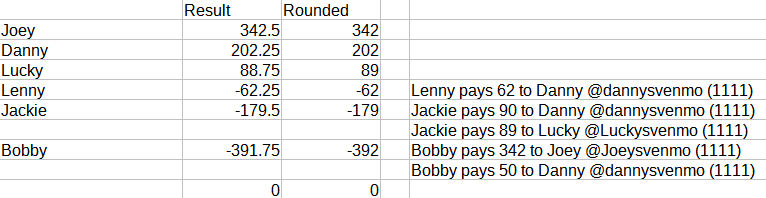

I start everyone with the same amount of credit, let the night play out, and use the resulting balances to make a payment structure that gets everyone back to zero. Then I reset all balances to the default and send out an email that looks like this, only to the players involved:

If there's anything that requires a decision (e.g., which way to round 0.50 to make it all zero out), I flip a coin or draw a card or whatever. Same way I decide to who has to make more payments than the others, like Jackie and Bobby here, if it's necessary to do so.

Honestly, it's not bad. Once I got a good method down, I could knock this out pretty quickly. Importantly, it keeps my digital hands off the money. No one pays me and I pay no one, and I like it that way. (I've been taking a break from the game, so I'm not even involved as a player anymore.)

All this said, I consider e-payments a stopgap measure for a very specific problem. If I'm playing a live game, I'm cash in, cash out all day. A few other users have already articulated my concerns quite well.

I'm very interested to see how the new IRS rules with regard to reporting for peer-to-peer payments will play out in the coming months. I hear a lot of talk about people using F&F payments instead of business, but I wonder how much that will matter.

Be a hell of a thing to have to tell the IRS that all that money coming in and out isn't income, but you acting as the bank for an unlicensed gambling event every Wednesday for the past year.

I start everyone with the same amount of credit, let the night play out, and use the resulting balances to make a payment structure that gets everyone back to zero. Then I reset all balances to the default and send out an email that looks like this, only to the players involved:

If there's anything that requires a decision (e.g., which way to round 0.50 to make it all zero out), I flip a coin or draw a card or whatever. Same way I decide to who has to make more payments than the others, like Jackie and Bobby here, if it's necessary to do so.

Honestly, it's not bad. Once I got a good method down, I could knock this out pretty quickly. Importantly, it keeps my digital hands off the money. No one pays me and I pay no one, and I like it that way. (I've been taking a break from the game, so I'm not even involved as a player anymore.)

All this said, I consider e-payments a stopgap measure for a very specific problem. If I'm playing a live game, I'm cash in, cash out all day. A few other users have already articulated my concerns quite well.

I'm very interested to see how the new IRS rules with regard to reporting for peer-to-peer payments will play out in the coming months. I hear a lot of talk about people using F&F payments instead of business, but I wonder how much that will matter.

Be a hell of a thing to have to tell the IRS that all that money coming in and out isn't income, but you acting as the bank for an unlicensed gambling event every Wednesday for the past year.

Poker Zombie

Royal Flush

Any reason as to why you round the fracs? I understand rounding fracs to avoid the need for coins, but when cashless it seems like you aren't avoiding anything, except 2-3 keystrokes.I've never hosted a cashless game live. I've been hosting on a Mavens site since the pandemic, though, and that's of course cashless.

I start everyone with the same amount of credit, let the night play out, and use the resulting balances to make a payment structure that gets everyone back to zero. Then I reset all balances to the default and send out an email that looks like this, only to the players involved:

View attachment 1045325

If there's anything that requires a decision (e.g., which way to round 0.50 to make it all zero out), I flip a coin or draw a card or whatever. Same way I decide to who has to make more payments than the others, like Jackie and Bobby here, if it's necessary to do so.

Honestly, it's not bad. Once I got a good method down, I could knock this out pretty quickly. Importantly, it keeps my digital hands off the money. No one pays me and I pay no one, and I like it that way. (I've been taking a break from the game, so I'm not even involved as a player anymore.)

All this said, I consider e-payments a stopgap measure for a very specific problem. If I'm playing a live game, I'm cash in, cash out all day. A few other users have already articulated my concerns quite well.

I'm very interested to see how the new IRS rules with regard to reporting for peer-to-peer payments will play out in the coming months. I hear a lot of talk about people using F&F payments instead of business, but I wonder how much that will matter.

Be a hell of a thing to have to tell the IRS that all that money coming in and out isn't income, but you acting as the bank for an unlicensed gambling event every Wednesday for the past year.

Nine_high

3 of a Kind

People got charts and tables and graphs like they’re at work in the C-suite. I host and play poker to get away from work, not closer to it.

Straight cash homie. You give me cash I count it I give you chips you count them. Glgl.

You didn’t bring enough money? Maybe you should shut it down. You want to keep playing? Venmo or PP someone with money at the game other than me, bring me cash. I count it. I give you chips. You count them. We play. We drink. We’re merry.

If the bank is off, it’s on me. My drunk ass didn’t count the money right, or my drunk ass didn’t count the chips right. I make it right. Next time 3 less beers.

This is exactly what I do too. Cash for chips. I also live 5 minutes from several ATMs so that's always an option.

SendThatStack

3 of a Kind

Is everyone cool with a host (and possibly others) knowing exactly how much you’re up and down over a single session and a period of time with the ledger approach?

I couldn’t care less, but I’ve seen people in the past a bit miffed by it.

I don't really like it being put on a running ledger. Its not hard to know who is winning or losing on a particular night or over a number of nights just based on how many rebuys they have vs their cashouts.

Cash only. No one has every used a payment app to my knowledge. Short of cash? Someone will usually lend you what you need. We never "play on the books."

I'm part of a casual group that has been playing very low buy-in weekly (live and online) NLHE tourneys since 2003. We have a POY each year, and we maintain a web site with detailed stats on every player, including Mavens logs with hole cards.Is everyone cool with a host (and possibly others) knowing exactly how much you’re up and down over a single session and a period of time with the ledger approach?

I couldn’t care less, but I’ve seen people in the past a bit miffed by it.

I have no problem with this - it's the nature of the group, the stakes are so low as to be practically meaningless, and it's fun to needle players about their stats and be able to review Mavens hands after the fact.

OTOH, I'm not a fan of cash game ledgers. There's not a good reason I can think of for a host to maintain a ledger, and I prefer to be the only one who knows exactly how much I'm up/down long term.

bergs

Royal Flush

He has a proprietary rounding system that he’s very, very proud of.Any reason as to why you round the fracs? I understand rounding fracs to avoid the need for coins, but when cashless it seems like you aren't avoiding anything, except 2-3 keystrokes.

Sal Bandini

Pair

What's with all this ledger and logging bs? So if I want to go cashless I have to keep spreadsheets, get a laptop, get some pen/paper, dust off the slide rule, find fresh batteries for my HP-41CX? I thought cashless was the same as cash but in electronic form, but apparently not. Now I have to track everyone's transactions.

If I buy in your game for $50 and give you cash, you count it and hand me $50 in chips. If I Venmo (how did that become a verb?) you $50 you immediately see it on your phone, acknowledge it and hand me $50 in chips. When I cash out we count my stack and you either give me cash or Venmo me the money, either of which I confirm before I leave. No ledger or "Settled" or whatever other nonsense is needed. You also don't care what player owes another player, etc. Player pays host, host pays player, just like a bank or casino.

Venmo is supposed to be so simple and replacing cash, so treat it like that. Do you Venmo your friend for a lunch or bet you made and then have to create a ledger for that? No, you see it on your phone and it's settled. This thread should really be called "How to complicate buying in and cashing out in a home game."

If I buy in your game for $50 and give you cash, you count it and hand me $50 in chips. If I Venmo (how did that become a verb?) you $50 you immediately see it on your phone, acknowledge it and hand me $50 in chips. When I cash out we count my stack and you either give me cash or Venmo me the money, either of which I confirm before I leave. No ledger or "Settled" or whatever other nonsense is needed. You also don't care what player owes another player, etc. Player pays host, host pays player, just like a bank or casino.

Venmo is supposed to be so simple and replacing cash, so treat it like that. Do you Venmo your friend for a lunch or bet you made and then have to create a ledger for that? No, you see it on your phone and it's settled. This thread should really be called "How to complicate buying in and cashing out in a home game."

- Joined

- Nov 22, 2018

- Messages

- 13,812

- Reaction score

- 29,761

- Location

- 129 West 81st Street, Apartment 5B

Some of you must just be a barrel of fun, and it shows  .

.

This thread is literally for "what you can do if you run/need/want to run a cashless game". The OP literally says avert your eyes if this isn't your thing. Cue every single person who doesn't want to do this in their home game posting.

Regarding the tabulations, I get some people not wanting their business jotted down on paper. But as you've said, there's not a ton to that argument as host and players can easily tabulate that throughout and at the end of the game, and if they wanted to track that they could. For those of us who care enough to spend thousands on chips, to go over the game selection via text for a week before playing, that look forward getting cards in the air - it's kind of cool to have a history of that.

Your first name, last name, ssc, and driver's license aren't on the ledger. And I think it's pretty fun to have a history and to say oh shit, yeah let's play this instead because we played such and such last time. Or, oh hell I remember I had to put like $10 in the swear jar that weekend.

I don't have a personal take. If someone is hosting, I do what the host says. If I'm hosting, I do what the players want. Life can be so much easier when you're flexible....

This thread is literally for "what you can do if you run/need/want to run a cashless game". The OP literally says avert your eyes if this isn't your thing. Cue every single person who doesn't want to do this in their home game posting.

Regarding the tabulations, I get some people not wanting their business jotted down on paper. But as you've said, there's not a ton to that argument as host and players can easily tabulate that throughout and at the end of the game, and if they wanted to track that they could. For those of us who care enough to spend thousands on chips, to go over the game selection via text for a week before playing, that look forward getting cards in the air - it's kind of cool to have a history of that.

Your first name, last name, ssc, and driver's license aren't on the ledger. And I think it's pretty fun to have a history and to say oh shit, yeah let's play this instead because we played such and such last time. Or, oh hell I remember I had to put like $10 in the swear jar that weekend.

I don't have a personal take. If someone is hosting, I do what the host says. If I'm hosting, I do what the players want. Life can be so much easier when you're flexible....

Sal Bandini

Pair

Your first name, last name, ssc, and driver's license aren't on the ledger. And I think it's pretty fun to have a history and to say oh shit, yeah let's play this instead because we played such and such last time. Or, oh hell I remember I had to put like $10 in the swear jar that weekend.

Why are you punishing beneficial behavior?

https://www.amazon.com/Swearing-Good-You-Amazing-Language/dp/1324000287

- Joined

- Nov 22, 2018

- Messages

- 13,812

- Reaction score

- 29,761

- Location

- 129 West 81st Street, Apartment 5B

We don't. My wife came home to cook dinner for our players, so we had little ears around for a little over an hour.Why are you punishing beneficial behavior?

https://www.amazon.com/Swearing-Good-You-Amazing-Language/dp/1324000287

This was just a fun side game to play. If this was for the game, it would be significantly higher than $21!

Jimulacrum

Full House

Personal preference, mainly. I never bother with change in live poker, so I carried that philosophy over to my club when I started it up. Rounding is super-fast and makes it a little easier to sort out the payments.Any reason as to why you round the fracs? I understand rounding fracs to avoid the need for coins, but when cashless it seems like you aren't avoiding anything, except 2-3 keystrokes.

The players seem to be happy with it. I've even had a request to round to the nearest 5 instead of 1.

Jimulacrum

Full House

Patent pending.He has a proprietary rounding system that he’s very, very proud of.

Jimulacrum

Full House

In theory, yes, a service like Venmo should make the process as simple as cash, minus the physical passing of rectangles.What's with all this ledger and logging bs? So if I want to go cashless I have to keep spreadsheets, get a laptop, get some pen/paper, dust off the slide rule, find fresh batteries for my HP-41CX? I thought cashless was the same as cash but in electronic form, but apparently not. Now I have to track everyone's transactions.

If I buy in your game for $50 and give you cash, you count it and hand me $50 in chips. If I Venmo (how did that become a verb?) you $50 you immediately see it on your phone, acknowledge it and hand me $50 in chips. When I cash out we count my stack and you either give me cash or Venmo me the money, either of which I confirm before I leave. No ledger or "Settled" or whatever other nonsense is needed. You also don't care what player owes another player, etc. Player pays host, host pays player, just like a bank or casino.

Venmo is supposed to be so simple and replacing cash, so treat it like that. Do you Venmo your friend for a lunch or bet you made and then have to create a ledger for that? No, you see it on your phone and it's settled. This thread should really be called "How to complicate buying in and cashing out in a home game."

In reality, there are many risks involved that don't exist with cash—specifically taxes, e-wallet policies, and (probably to a lesser degree) criminal codes.

The ledger system minimizes all of these risks, inasmuch as you can minimize them when you're choosing to create an electronic record.

It may be more complicated on its face, but it's a lot less complicated than dealing with the funds getting frozen or having to deal with a mess in your taxes.

SendThatStack

3 of a Kind

After some more thought on this I actually dont want to know exactly how much someone is up or down in my game. Would make me start to feel bad for some of them

Poker Zombie

Royal Flush

Oddly, the only stat we do not track is "how much" any player has won or lost. In theory, it could be calculated but it would not be an easy endeavor. Stats work better for tournaments than cash games, and cash games are limited to no more than once a year.After some more thought on this I actually dont want to know exactly how much someone is up or down in my game. Would make me start to feel bad for some of them

THIS, 100%What's with all this ledger and logging bs? So if I want to go cashless I have to keep spreadsheets, get a laptop, get some pen/paper, dust off the slide rule, find fresh batteries for my HP-41CX? I thought cashless was the same as cash but in electronic form, but apparently not. Now I have to track everyone's transactions.

If I buy in your game for $50 and give you cash, you count it and hand me $50 in chips. If I Venmo (how did that become a verb?) you $50 you immediately see it on your phone, acknowledge it and hand me $50 in chips. When I cash out we count my stack and you either give me cash or Venmo me the money, either of which I confirm before I leave. No ledger or "Settled" or whatever other nonsense is needed. You also don't care what player owes another player, etc. Player pays host, host pays player, just like a bank or casino.

Venmo is supposed to be so simple and replacing cash, so treat it like that. Do you Venmo your friend for a lunch or bet you made and then have to create a ledger for that? No, you see it on your phone and it's settled. This thread should really be called "How to complicate buying in and cashing out in a home game."

I just stumbled into this thread and have a great interest, as I'm planning to start hosting more regularly. My group is also a mix of older and younger guys, so I expect this may come up at some point. I have a strong preference for cash, and have insisted on cash buy-ins up to this point. But I'm open to cashless transactions, as I expect the demand to only increase, and I understand those who prefer not to carry cash.

Like the comment above, anyone in my game who doesn't have enough cash for a buy-in or rebuy could Venmo or PP me immediately, before getting chips. Then I would put my cash into the game's cash envelope. At the end of the night, we could settle that player's winnings with cash, or a Venmo back. Whichever we both agree on. I don't use Venmo very often, so my preference would usually be to send some or all of it back to them.

It's highly unlikely I would allow players to play on credit, therefore I don't see much need to keeping a ledger. That would make playing poker seem more like work!!! (I'm an accountant)

Jimulacrum

Full House

I'm adamantly opposed to Venmo for live games, but if you're going to do it, the ledger system makes sense.THIS, 100%

I just stumbled into this thread and have a great interest, as I'm planning to start hosting more regularly. My group is also a mix of older and younger guys, so I expect this may come up at some point. I have a strong preference for cash, and have insisted on cash buy-ins up to this point. But I'm open to cashless transactions, as I expect the demand to only increase, and I understand those who prefer not to carry cash.

Like the comment above, anyone in my game who doesn't have enough cash for a buy-in or rebuy could Venmo or PP me immediately, before getting chips. Then I would put my cash into the game's cash envelope. At the end of the night, we could settle that player's winnings with cash, or a Venmo back. Whichever we both agree on. I don't use Venmo very often, so my preference would usually be to send some or all of it back to them.

It's highly unlikely I would allow players to play on credit, therefore I don't see much need to keeping a ledger. That would make playing poker seem more like work!!! (I'm an accountant)

The reason is simple: it's inadvisable to create a large number of transactions that look like gambling, and that's exactly what it looks like when you collect $50, $50, $50, $50, $50 repeatedly from 8 different players and then disburse it all differently at the end of the night. It creates a legitimately suspicious trail for exactly the activity you're engaging in, which is prohibited on Venmo and may get your account/funds locked (to say nothing of potential tax issues).

With a ledger, instead you track everything and issue settle-up instructions to everyone else. Instead of the host eating the risk of $1,000 in buy-ins and another $1,000 in payouts (much of which was never actually his money), the host instructs the players to pay each other in ways that settle everything. Only the aggregate net +/– of all the transactions actually changes hands (instead of twice the value of all buy-ins), and importantly, the transactions are spread out and don't look like a host collecting gambling money and paying it out.

TLDR: Just use cash.

Similar threads

- Replies

- 28

- Views

- 603

- Replies

- 19

- Views

- 657